tax avoidance vs tax evasion examples

Compared to other countries Americans are more likely to pay their taxes fairly honestly and on time. Tax and small business.

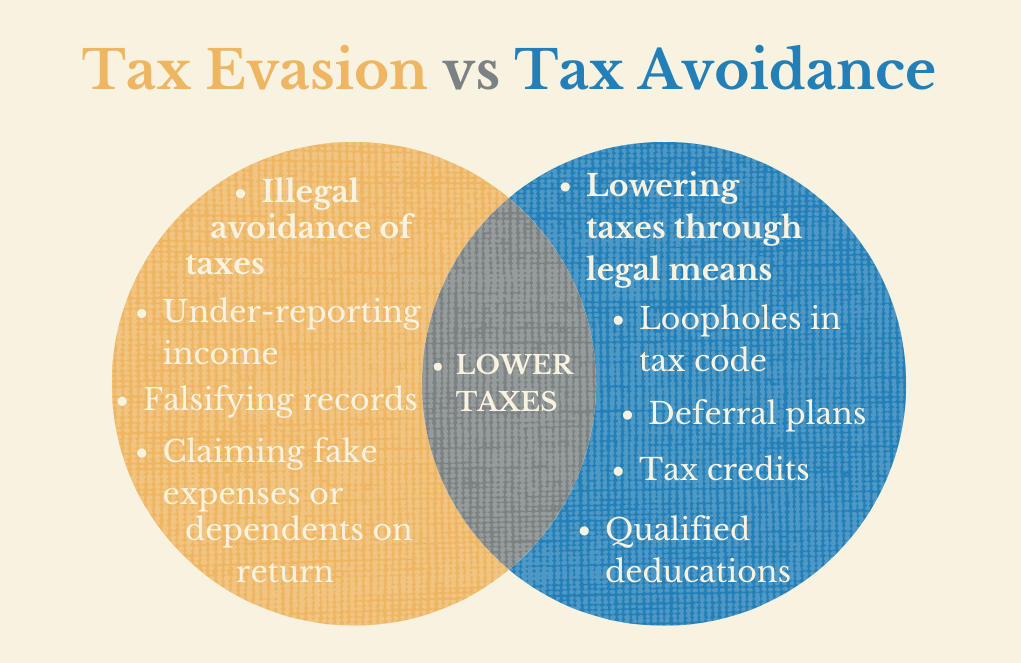

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Hence she decides to save for her retirement in the Savers Credit account.

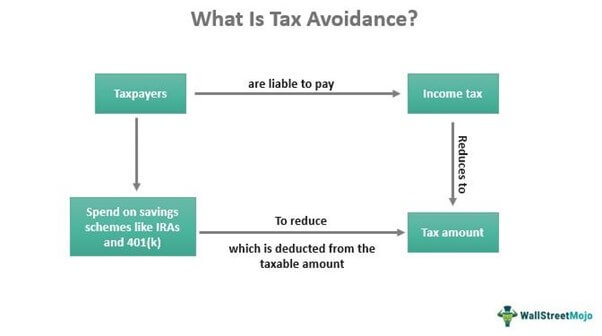

. Tax avoidance is the use of legal methods to modify an individuals financial situation to lower the amount of income tax owed. View examples PDF 57KB on how to compute the amount of tax exemption under the tax exemption scheme for new start-up companies. Tax evasion is most commonly thought of in relation to income taxes but tax evasion can be practiced by businesses on state sales taxes and on employment taxes.

Conviction of tax evasion may result in fines and imprisonment. It can impose new taxes or abolish existing ones or can use measures to broaden the tax base. Under the federal law of the United States of America tax evasion or tax fraud is the purposeful illegal attempt of a taxpayer to evade assessment or payment of a tax imposed by Federal law.

Sarah had an average gross income and is left with a service tenure of 10 years. Read more and avoiding tax evasion by entities. Dependent upon the tax measure it will have a positive or a negative impact on the financial market.

Definitions of the terms used to explain small business entity concessions. Tax avoidance is different from tax evasion. Promoting competitiveness among the associated enterprises.

It usually occurs when the same income is taxed both at corporate as well as at the individual level. This is generally accomplished by claiming the permissible. Tax and individuals - not in business.

Tax and Corporate Australia. The fight against tax crime. Companies whose principal activity are that of investment holding.

The government can try to change the tax rates. Your aggregated turnover is your annual turnover all ordinary income you earned in the ordinary course of running a business for the income year plus the annual turnover of any entities you are connected with or that are your affiliates. How Tax Residency Affects Corporate Income Tax While tax resident and non-resident companies are generally taxed in the same manner tax resident companies enjoy certain benefits such as.

In each of these cases it will affect the income and consumption pattern of a large number of people. Qualifying Conditions for Tax Exemption Scheme for New Start-Up Companies. One common tax evasion strategy is failing to pay turn over taxes you have collected from others to the proper federal or state agency.

Fix a mistake or amend a return. Let us consider the following tax avoidance examples to understand the concept and the process better. All new start-up companies are eligible for the tax exemption scheme except.

Dispute or object to an ATO decision. Exemption or reduction in tax imposed on specified foreign income that is derived in a jurisdiction that has an Avoidance of Double Taxation Agreement DTA. Avoidance of double taxation Double Taxation Double Taxation is a situation wherein a tax is levied twice on the same source of income.

Tax Evasion Vs Tax Avoidance Dsj Cpa

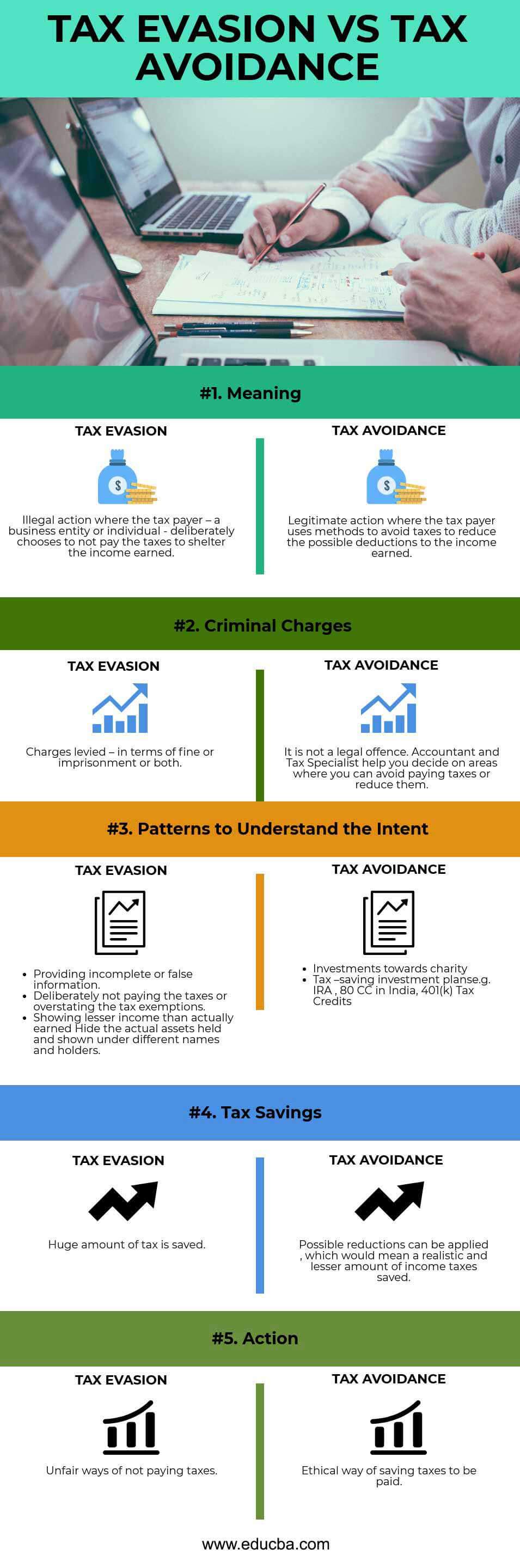

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Differences Between Tax Evasion Tax Avoidance And Tax Planning

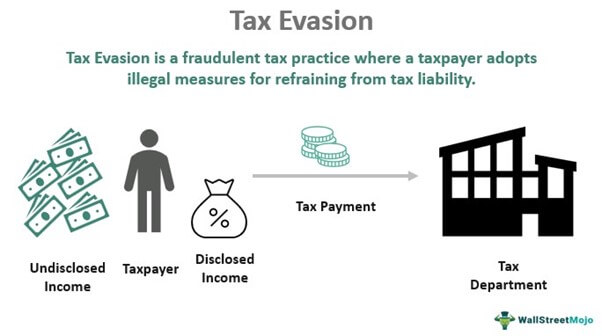

Tax Evasion Meaning Types Examples Penalties

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion Vs Tax Avoidance Vs Tax Planning A Detailed Comparison With Examples Urdu Hindi Youtube

Tax Evasion Tax Avoidance Definitions Differences Nerdwallet

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Tax Avoidance Definition Comparison For Kids

Tax Avoidance Meaning Methods Examples Pros Cons

Investopedia Video Tax Avoidance Vs Tax Evasion Youtube

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics